Although impact investment is in its beginning phases in South Africa, with social entrepreneurs and funders currently trying out different organisational structures and funding mechanisms we anticipate rapid growth.

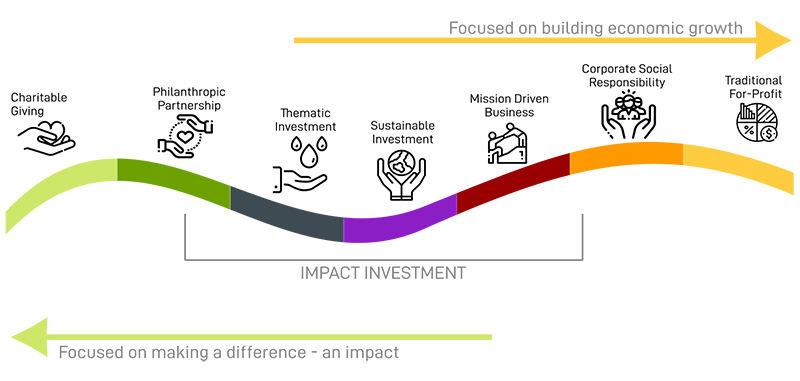

South Africa has a history of financial innovation and increased reporting pressures mean that ever more funders are looking to take a more strategic direction to their charitable investments. This means project intiators, owners and managers need to be aware of the investors intent, the investment risk assoviated with their project and have a clear idea how they will measure the impact of their projects. Impact investing at its core means building a diverse partnerships between eNGOs and funders.